Economic forecasts,

for the greater Seattle area.

Consider us your research center, providing you answers in easy to understand language and charts.

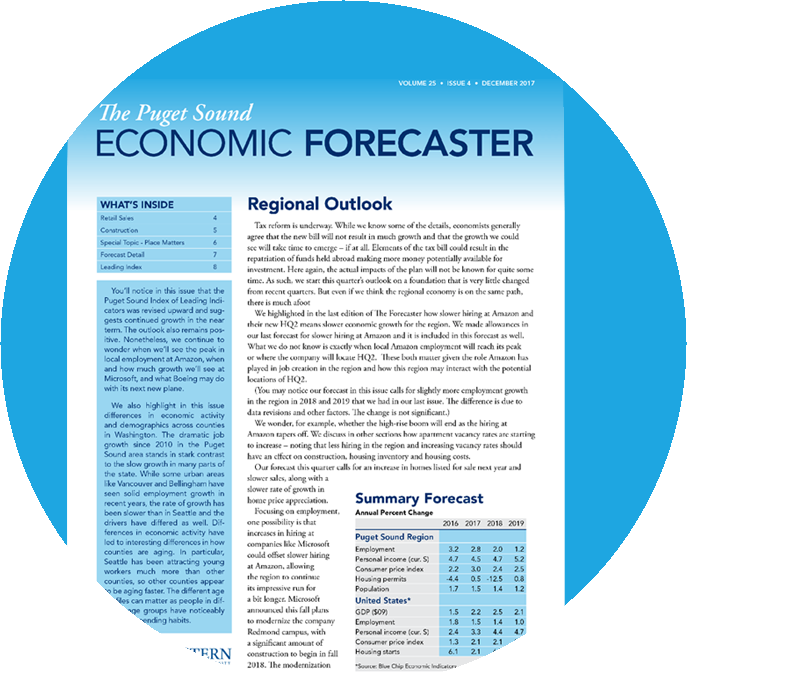

Established in 1993, The Puget Sound Economic Forecaster is a quarterly report published by the Center for Economic and Business Research at Western Washington University which acquired the publication in 2017 from its founders, Conway Pedersen Economics, Inc.

The report and website are designed for business executives, marketing directors, investors, government managers, and researchers who need a professional and objective view on the economic prospects for the Puget Sound region (King County, Kitsap County, Pierce County, and Snohomish County).

Our goal is to provide accurate and well-reasoned forecasts for the region as well as clear and insightful observations on important developments in the economy.

In-Depth Regional Economic Outlook

The first issue of the

Puget Sound Economic Forecaster,

a quarterly report,

was published in December 1993.

Each report contains a summary forecast, in-depth discussion of the regional outlook, forecasts and analyses of retail sales and construction and real estate, a special topic (e.g., China and Population Change), a detailed forecast table, and the Puget Sound Index of Leading Economic Indicators.

To facilitate research and analysis on the regional economy, every issue of the regional economic report is archived as a downloadable PDF file in the Subscriber Area. A comprehensive Subject Index of the archived reports has been developed to aid in the retrieval of information.

Reports are posted to the web site one to two weeks before the printed copy is mailed.

Sample Report – Data, Trade and Trends [Volume 27, Number 2, June 2019]

With thoughts of the long warm days of summer on our minds, we have found ourselves interrupted pondering about the price of avocados and how the latest round of tariff threats that may impact retail sales and the general economy overall. Thoughts of spending time at the lake or river have found us considering stream flows and how the change in our climate may impact all of the people and businesses that rely on water in one way or another. Daydreams of patio and deck BBQs have caused us to reflect on changes in house prices and the sudden growth in sales outside of the King County – is it more commuters or are jobs moving? Will the Seattle to Everett corridor retain its worst traffic in the nation ranking? Evidently, economists are bad at not thinking about things. All of the above is ahead in this edition of the Forecaster plus a better understanding of workforce participation and the state forecast. We will just call it the beach edition.

Additional Features

In addition to the Quarterly Report,

we regularly publish

Additional Feature Reports

Breaking News

What We Are Following in the News

The latest Labor Department Producer Price Index, released yesterday, showed that President Trump’s levies drove up the wholesale cost of goods, an increase offset by a drop in the cost of travel-related services. It’s the latest sign that tariffs are starting to affect the broader economy, keeping the Fed in a wait-and-see mode when it comes to interest-rate cuts. https://buff.ly/VaFnETh

U.S. total business end-of-month inventories for May 2025 were $2,656.7 billion, virtually unchanged (+/- 0.1 percent)* from last month. U.S. total business sales were $1,913.9 billion, down 0.4 percent (+/- 0.2 percent) from last month. May 2025: 0.0* % Change in Inventories April 2025 (r): 0.0* % Change in Inventories

Questions? We Love Questions!

We receive a wide-range of questions every day and would love to hear yours. Questions lead to data and data should lead to better questions.

Special Topics

Special topics in each report

intended to increase the

reader’s understanding of

how the Puget Sound economy works

Past topics include regional growth, labor productivity, demographic trends, inflation, multipliers, entrepreneurs, and state and local taxes.

Web site subscribers currently have access to more than fifty special topics. Here are four examples drawn from the Special Topic Archive: